THE 2025 RISK REPORT WILL BE RELEASED IN MARCH

Crypto/investment scams #1 riskiest in 2024

Investment scams, including those involving cryptocurrency, remained the riskiest scam type in 2024, according to a new report from the Better Business Bureau. Romance/friendship scams climbed to No. 3 riskiest for the first time since BBB began publishing the report.

Both types of scams involve financial grooming, where the scammer builds a relationship with the victim before perpetrating the scam.

More than 80 percent of people who were targeted by investment/cryptocurrency scams, No. 1 riskiest, reported losing money to BBB Scam Tracker. It also had the second highest median dollar loss at $5,000. Investment scams take many forms, including pressure to purchase, trade, or store digital assets (cryptocurrency) with fraudulent exchanges.

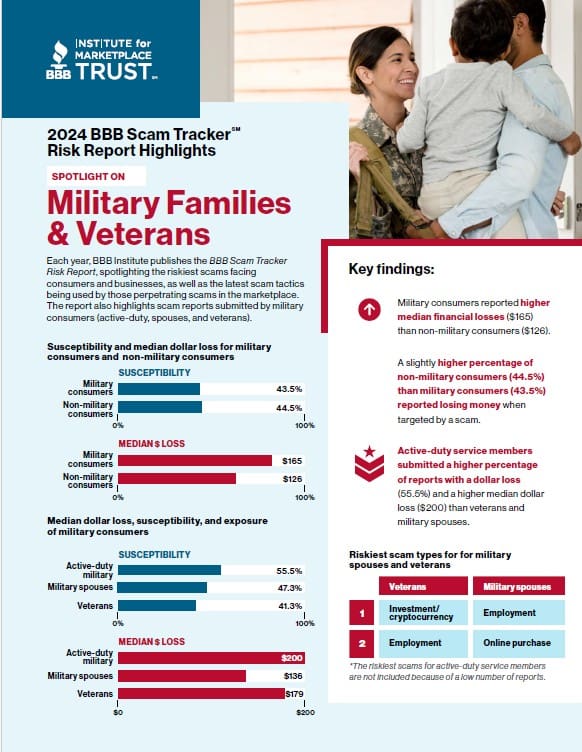

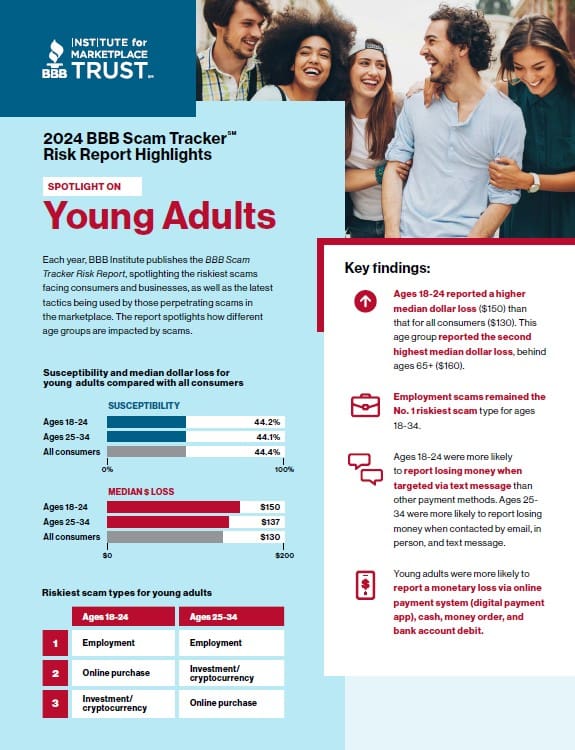

The report includes insights about how scams are perpetrated, who is being targeted, which scams have the greatest impact, and behaviors and factors that may impact an individual’s susceptibility.

Read and download the full report

Click above to access the report. Download and share our highlights sheets below.

For more information about the contents of this report, or to schedule a presentation about its findings, please contact us.